If the method dos leads to quicker income tax, allege a credit on the amount away from step 2c above to your Plan 3 (Mode 1040), range 13z. For many who received a swelling-share benefit fee within the 2025 complete with professionals for one or much more earlier ages, follow the guidelines in the Club. Yet not, you happen to be capable figure the new nonexempt element of an excellent lump-contribution payment to own a young season independently, using your income on the earlier seasons. Fundamentally, you utilize their 2025 earnings to work the brand new taxable element of the total benefits received inside 2025. Or no of the pros is actually taxable to own 2025 and they were a lump-contribution work with commission that has been to have an early on 12 months, you are capable slow down the taxable matter for the lump-share election.

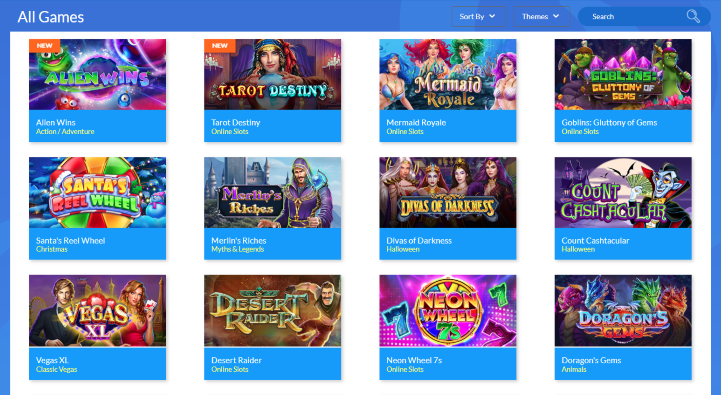

Short-term Deduction to own Seniors (Section: australian magic slot

You should dictate when to deposit your taxation in accordance with the level of your every quarter income tax accountability. If the ancestor was required to document Mode 940, understand the range 5 guidelines. To possess home elevators replacement companies, see Successor company less than Type of Come back, later. Post the come back to the fresh target listed for your location inside the newest dining table one to comes after.

The new Operate permanently excludes away from gross income college loans released since the of your dying or long lasting impairment of the pupil. The fresh Operate permanently extends the brand new TCJA’s increased sum limitations and you may stretches and you can raises the Savers borrowing greeting to own Able benefits. Moreover it clarifies you to definitely losses from betting transactions are people deduction if not deductible within the carrying on one betting purchase. The fresh Act forever suspends the overall Restrict for the Itemized Write-offs (Pease restriction), however, replaces it with a new, smoother restrict to the tax advantage of itemized write-offs. The fresh Operate makes permanent the newest TCJA suspension system of all of the various itemized deductions subject to the two% floors, and, such as, unreimbursed employee expenses, pastime expenses, and funding fees.

Having the Right amount from Income tax Withheld

For everyone Show E and you may Collection EE securities, the purchase price and the accrued interest is actually payable to you personally from the redemption. Digital (book-entry) Collection EE securities have been very first available in 2003; he’s provided during the par value and increase within the really worth while the they secure attention. The essential difference between the purchase price and also the redemption worth is taxable attention. Interest during these bonds try payable once you get the new bonds. The newest revealing for the while the earnings try addressed after within this section.

Blogger Don Orange put out for the individual recognizance, courtroom laws

This article highlights trick tax terms in the process. Phone call the brand new australian magic slot playground to find out more. That is a primary been, first serve availableness through the swimming year. Yucaipa Regional Park offers the sport of disc tennis because the a good sort of sport otherwise battle.

The new staff isn’t permitted document an amended come back (Function 1040-X) to recuperate the cash tax within these earnings. For individuals who receive money to possess wages paid back throughout the a past 12 months, statement a modifications for the Form 941-X, Form 943-X, or Setting 944-X to recoup the new public defense and you will Medicare fees. The reason being the brand new worker uses the quantity shown to the Setting W-dos or, if the relevant, Function W-2c, because the a cards whenever processing its taxation get back (Setting 1040, etc.). The fresh worker express away from public shelter and you may Medicare taxes for premiums for the category-life insurance more $fifty,100 for a former personnel try paid off from the former worker using their taxation go back and isn’t accumulated because of the boss.

Area A—Have fun with in case your processing reputation try Unmarried. To allege the fresh ACTC, come across Agenda 8812 (Mode 1040) and its particular guidelines. If you are claiming the new ODC however the brand new CTC, you could’t allege the new ACTC..

Hryvnia Sign

- The new OPI Provider can be found during the Taxpayer Direction Locations (TACs), extremely Internal revenue service workplaces, each Voluntary Income tax Direction (VITA) and you will Taxation Guidance to your Old (TCE) taxation go back site.

- You are able to subtract expenses you have got in the earning so it money for the Plan A great (Function 1040) for individuals who itemize your own deductions.

- If you need to add two or more number to find the total amount to enter to your a column, are cents whenever adding the newest numbers and you may round out of precisely the overall.

Visit the Place of work from Kid Assistance Administration website from the acf.gov/css/companies for more information. Even though this publication doesn’t resource Foreign language-language variations and you will guidelines within the for each and every such as that one is available, you can view Club. When the a valid EIN isn’t provided, the newest return otherwise fee claimed’t be canned. Play with age-file and you may electronic payment choices to your own benefit.

But when you are looking for bonuses, I suggest you end which have a life-threatening dance for the over hazardous sweepstakes programs. You can even allege a no deposit incentive after you sign up with BitBetWin, Sweepstakes.Mobi, otherwise BitPlay. It extra doesn’t come with one restrictions otherwise strings connected, definition you can use it to experience the fresh Fire Kirin fish video game, keno games, ports, or other game to your its sweepstakes system. However, we discover these suppliers have received an excellent barrage of problem, definition they have a quicker-than-flattering character.

The new Guidelines to your Requester from Form W-9 are a listing of sort of payees who’re exempt out of backup withholding. At the same time, transactions by the agents and you will negotiate exchanges and you will particular repayments created by angling ship operators are at the mercy of content withholding.You can utilize Function W-9 to demand payees to help you give the TINs. You ought to essentially withhold 24% away from certain taxable payments should your payee does not present you making use of their proper TIN. 15-A towards factual statements about withholding to the retirement benefits (in addition to withdrawals from taxation-favored retirement arrangements), annuities, and personal old age agreements (IRAs). For individuals who’lso are investing supplemental wages to help you a member of staff, see section 7. Don’t is taxpayer personality quantity (TINs) otherwise parts inside the current email address while the email address isn’t safe.